Investing can often feel like trying to navigate a maze, especially if you are new to the world of finance. One question that often comes up is whether the specific day or time of the month you choose to invest matters or if it is more about how long you stay invested. I had some free time over the weekend and thought it might be interesting to test whether the timing of investments—specifically, whether investing a set amount every day versus investing on a specific day of the week—affects returns.

What is Passive investing?

Before we dive into the strategies, let’s start with the basics. Passive investing is all about a hands-off approach. Instead of constantly buying and selling, you invest a fixed amount regularly, like every month, and let your money grow over time. This method is popular because it is simple and does not require you to be a financial expert. In some countries, this regular investing is called a Systematic Investment Plan (SIP).

The Power of the S&P 500

One of the easiest ways to get started with passive investing is by putting your money into an index fund, like the S&P 500. This index tracks the top 500 companies in the U.S., offering a slice of the whole economy. Simply put, it serves as a proxy for the U.S. economy, as it comprises the top 500 companies that represent key sectors of the market. Many financial experts recommend it as a solid choice for beginners and seasoned investors alike because it is diversified and has a track record of long-term growth.

Testing the Weekday Gods: Does the day matter?

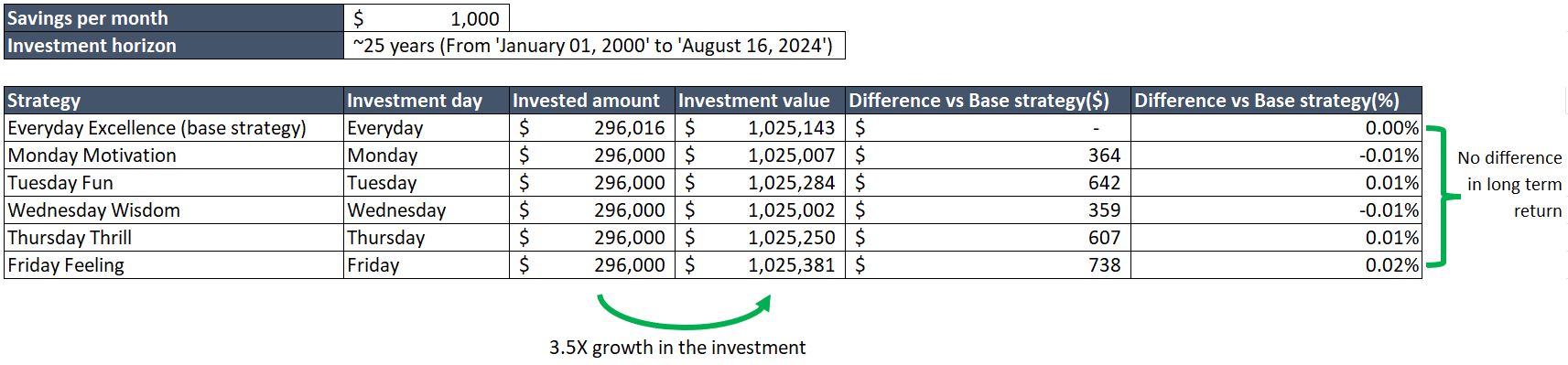

To find out if the day you invest matters, I tested several strategies:

- Everyday Excellence(base strategy): Spreading your investment evenly across all weekdays.

- Monday Motivation: Investing every Monday.

- Tuesday Fun: Investing every Tuesday.

- Wednesday Wisdom: Investing every Wednesday.

- Thursday Thrill: Investing every Thursday.

- Friday Feeling: Investing every Friday.

Each strategy involved saving and investing USD 1,000 per month. The question was: Does investing on a specific day of the week make a difference in returns compared to spreading it out over the whole week?

What I Found

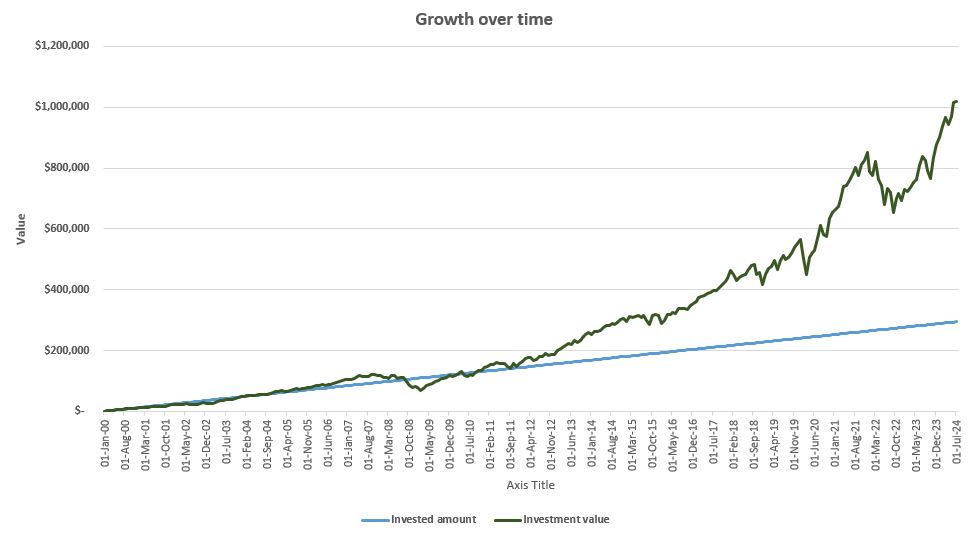

The results might surprise you. There was no significant difference in returns between any of the strategies. Whether you are motivated on Monday or feeling the Friday vibes, what really matters is that you are investing regularly. The key takeaway? Consistency is more important than timing.

By sticking to a regular investing schedule, you can ride out the ups and downs of the market and still come out ahead in the long run. In fact, if you had invested USD 1,000 per month in the S&P 500 from the year 2000 until August 2024, your investment would have grown to about one million dollars today.

Note: For simplicity, I’ve excluded dividends and their reinvestment from this analysis. Reinvesting dividends would further increase the value of the million-dollar investment in this example. (For context, dividends are payments companies make to their shareholders, typically on a quarterly or annual basis. These can be reinvested to purchase additional shares, which can grow in value over time.)

What’s next?

This article is just the beginning. I will be writing more about other popular indices and exploring different investment strategies, like:

- Investing once per month.

- Investing twice per month.

- Investing when there is a dip in the market.

Each strategy will have its own flavor and name, just like the weekday gods I have talked about today. My goal is to keep it simple, so that anyone, no matter their level of financial knowledge, can follow along and learn how to grow their money.

Stay tuned for the next part of this series, where I will explore more ways to invest smartly and consistently!

Disclaimer: https://vinaysachdeva.com/disclaimer/. The opinions expressed in the blog post are my own and do not reflect the view(s) of my employer. The author might have stock ownership in the companies described in this blog post. Data Source- https://www.investing.com/indices/us-spx-500-historical-data