This is a continuation of my previous post: https://www.vinaysachdeva.com/daily-weekly-or-whenever-whats-the-best-day-to-invest-exploring-the-impact-of-timing-in-snp-500-index-investing/

In my previous post, I explored whether investing on a specific day of the week impacts your returns when investing in the S&P 500 or any other index. The results were clear: consistency mattered more than the day of the week. Now, I am taking it a step further to answer another common question—does it make a difference if you invest on a particular day of the month?

Testing Monthly Timing: Does the date matter?

Much like before, I set out to determine whether investing on a specific day of the month impacts returns. Does it make a difference if you invest on the first day of the month, or mid-month, or does splitting the amount between two dates yield better results? The idea is to see if there is an advantage to timing your investments to a specific day, or if, once again, consistency wins out.

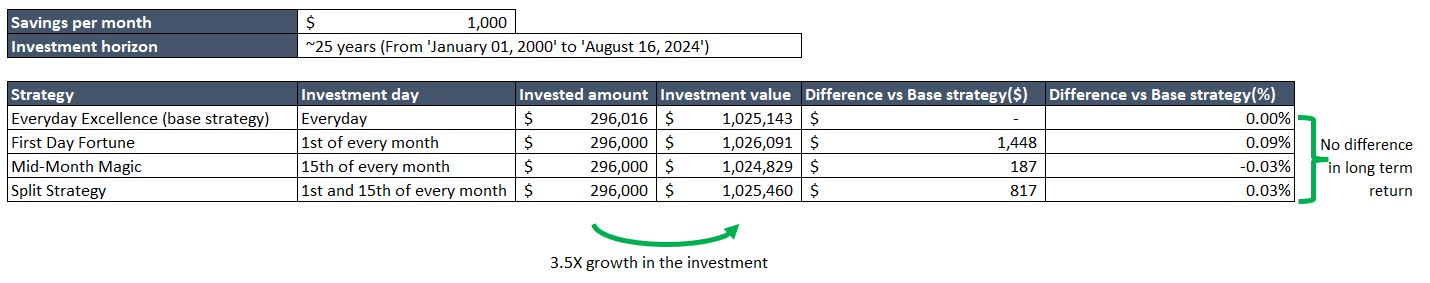

As with the previous experiment, the goal remains simple: invest USD 1,000 per month. I will test three different strategies and compare it to the base strategy:

- Base strategy: “Everyday Excellence”: Investing an equal amount every day throughout the month.

- First Day Fortune: Investing the full amount on the 1st of every month.

- Mid-Month Magic: Investing the full amount on the 15th of every month.

- Split Strategy: Dividing the investment equally between the 1st and the 15th of every month.

What I Found

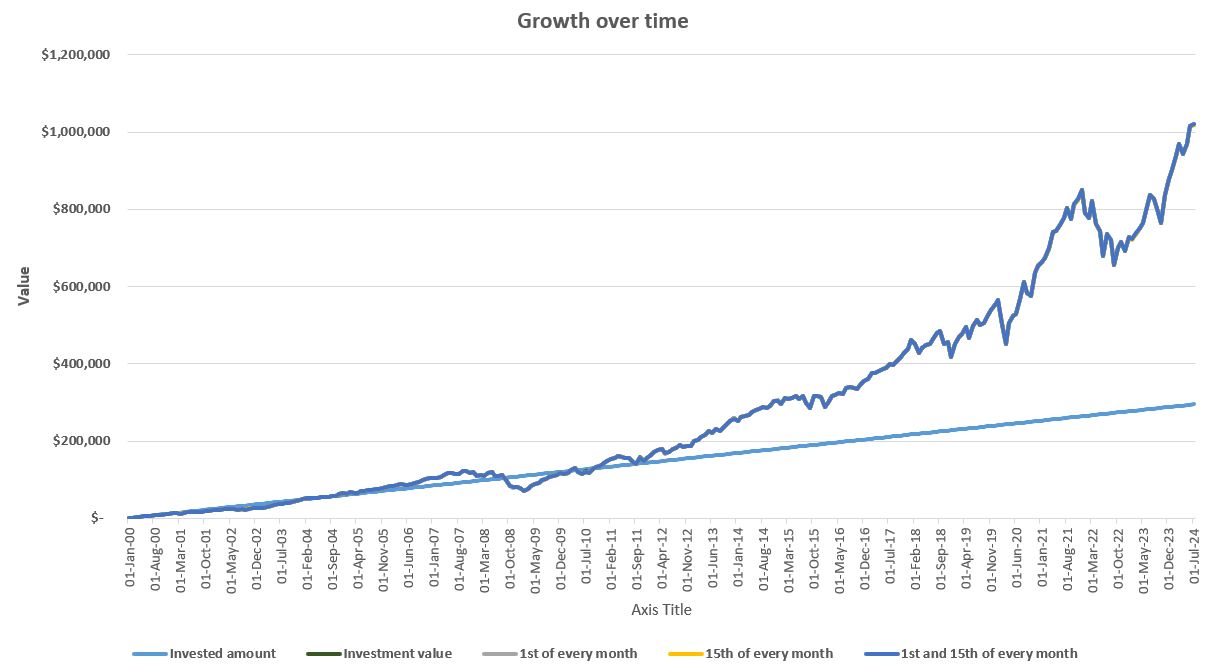

Just like with weekly investments, there was no significant difference in long-term returns across these strategies. Whether you invest on the 1st, the 15th, or split the difference between the two, the outcome remains the same. The most important takeaway is that you need to invest regularly and consistently.

In the long run, it does not matter which day of the month you choose to invest. What truly matters is that you stay committed to investing every month over a long period. This consistent approach allows your portfolio to grow and benefit from the compounding effect, which is the real engine behind significant wealth accumulation.

Note: For simplicity, I’ve excluded dividends and their reinvestment from this analysis. Reinvesting dividends would further increase the value of the million-dollar investment in this example. (For context, dividends are payments companies make to their shareholders, typically on a quarterly or annual basis. These can be reinvested to purchase additional shares, which can grow in value over time.)

The Power of Consistency

This experiment reinforces a key principle in investing: it is not about timing the market but about time in the market. The date on which you invest each month is far less important than the fact that you are consistently putting money into your portfolio. Over time, this regular investment will build your wealth, regardless of market fluctuations on any given day.

If you had invested USD 1,000 per month in the S&P 500 from the year 2000 until August 2024, your investment would have grown to about one million dollars today irrespective of your investment timing (every day/weekday/first of the month, etc).

What’s Next?

In the next part of this series, I will explore whether investing during market dips can lead to better returns compared to sticking to a regular schedule. Does timing your investments to coincide with market downturns really give you an edge? Or is it just another myth that’s better left alone?

Disclaimer: https://vinaysachdeva.com/disclaimer/. The opinions expressed in the blog post are my own and do not reflect the view(s) of my employer. The author might have stock ownership in the companies described in this blog post. Data Source- https://www.investing.com/indices/us-spx-500-historical-data