This is a continuation of my previous posts: https://www.vinaysachdeva.com/daily-weekly-or-whenever-whats-the-best-day-to-invest-exploring-the-impact-of-timing-in-snp-500-index-investing/ , https://www.vinaysachdeva.com/monthly-mid-month-or-both-does-your-investment-date-affect-returns-exploring-the-impact-of-timing-in-snp-500-index-investing/

In the first two posts, I explored whether investing on specific days of the week or certain days of the month affects returns when investing in the S&P 500. The findings were clear: Consistency matters more than timing. Now, let’s explore another popular strategy—investing during market dips. This idea is often talked about as a “hack” for getting better returns: buying when the market is down. But does it actually work?

The logic behind buying the dip

At first glance, buying the dip seems like a smart strategy. The logic is simple: if you buy stocks at a lower price, you are setting yourself up for better returns when the market recovers. I too believed for a long time that buying when the market is down was the best way to maximize returns in investing (both long-term & short-term horizon). I thought I was being clever by waiting for the market to get down, unlike others who just invested in the monthly SIPs/or monthly contributions to their preferred investment portfolio without checking if they were buying at a low or high price. But is this strategy effective over the long term?

Testing the strategy: Does buying the dip work?

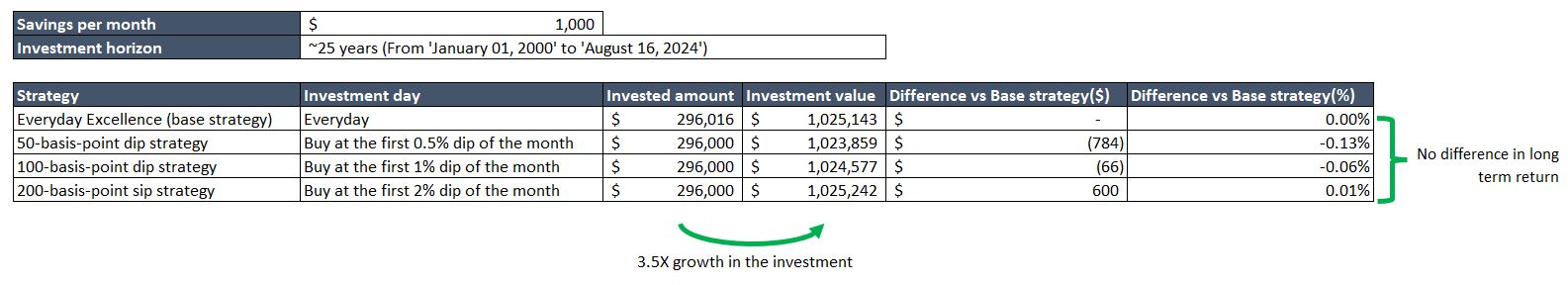

As with the previous experiment, the goal remains simple: invest USD 1,000 per month. I will test three different strategies and compare it to the base strategy:

- Base strategy “Everyday Excellence”: Investing an equal amount every day throughout the month.

- 50-basis-point dip strategy: Investing the full amount whenever the index drops* by 0.5% (50 basis points). If the index does not fall or drop* by this % in a given month, invest the $1,000 on the last day of the month.

- 100-basis-point dip strategy: Investing the full amount whenever the index drops* by 1% (100 basis points). If the index does not drop by this % in a given month, invest the $1,000 on the last day of the month.

- 200-basis-point sip strategy: Investing the full amount whenever the index drops* by 2% (200 basis points). If the index does not drop by this % in a given month, invest the $1,000 on the last day of the month.

*Note: A drop is defined as a price correction either between two consecutive days or relative to the average price over the last 15 days.

The surprising results

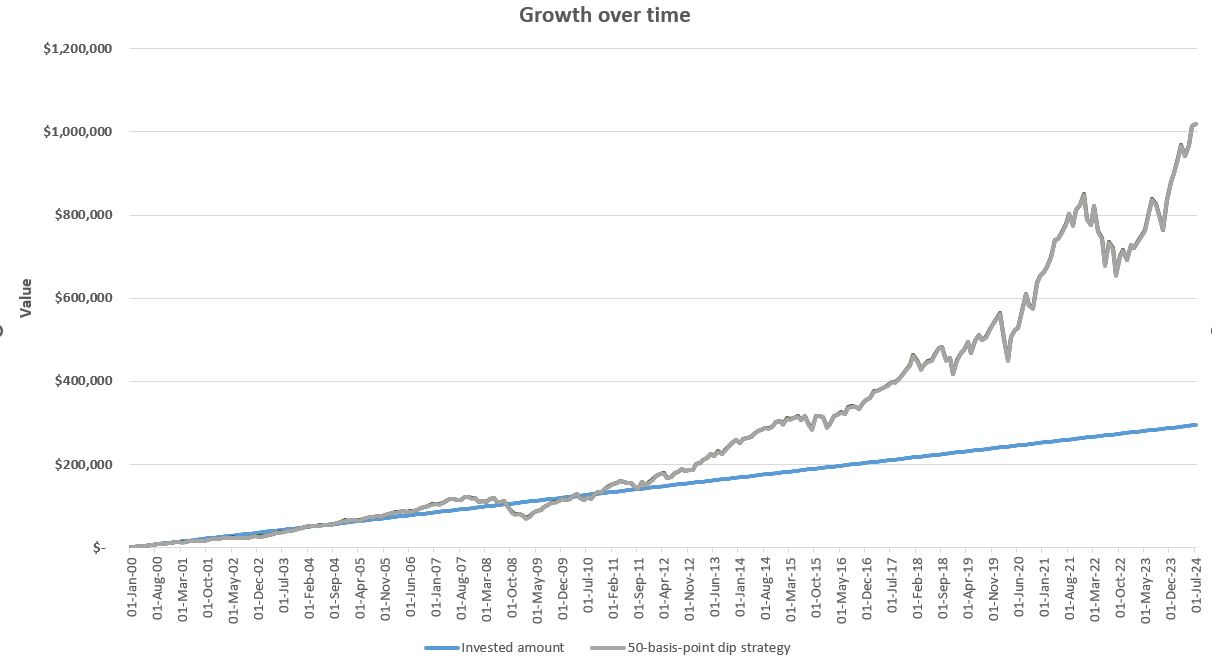

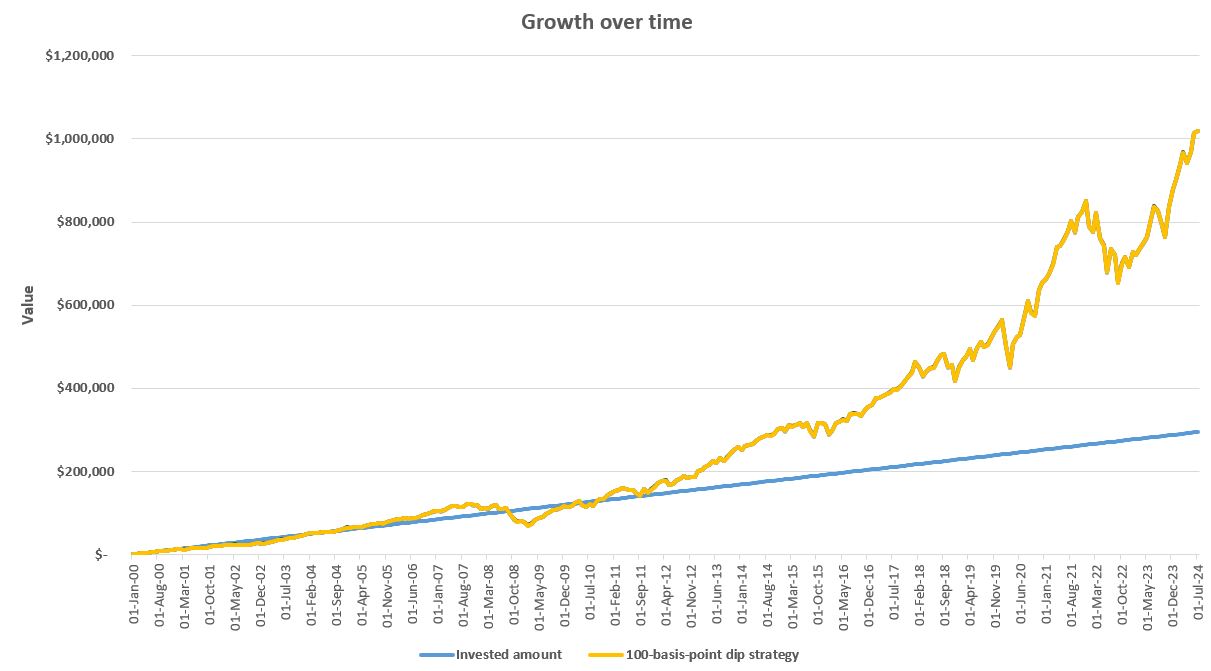

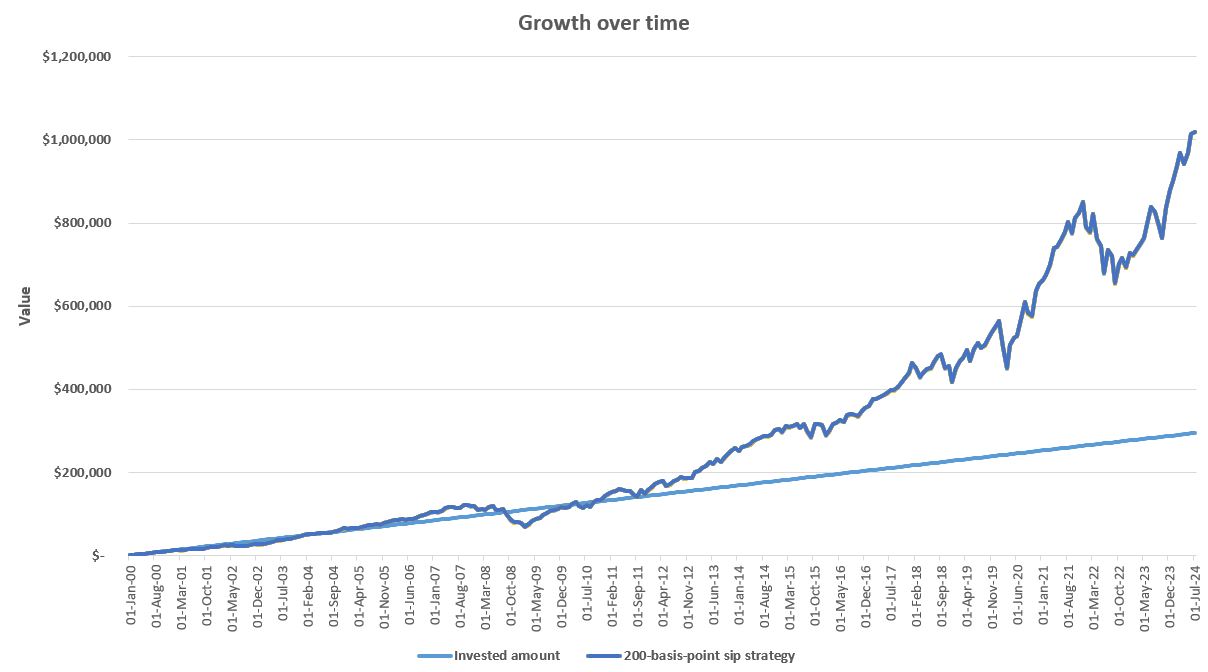

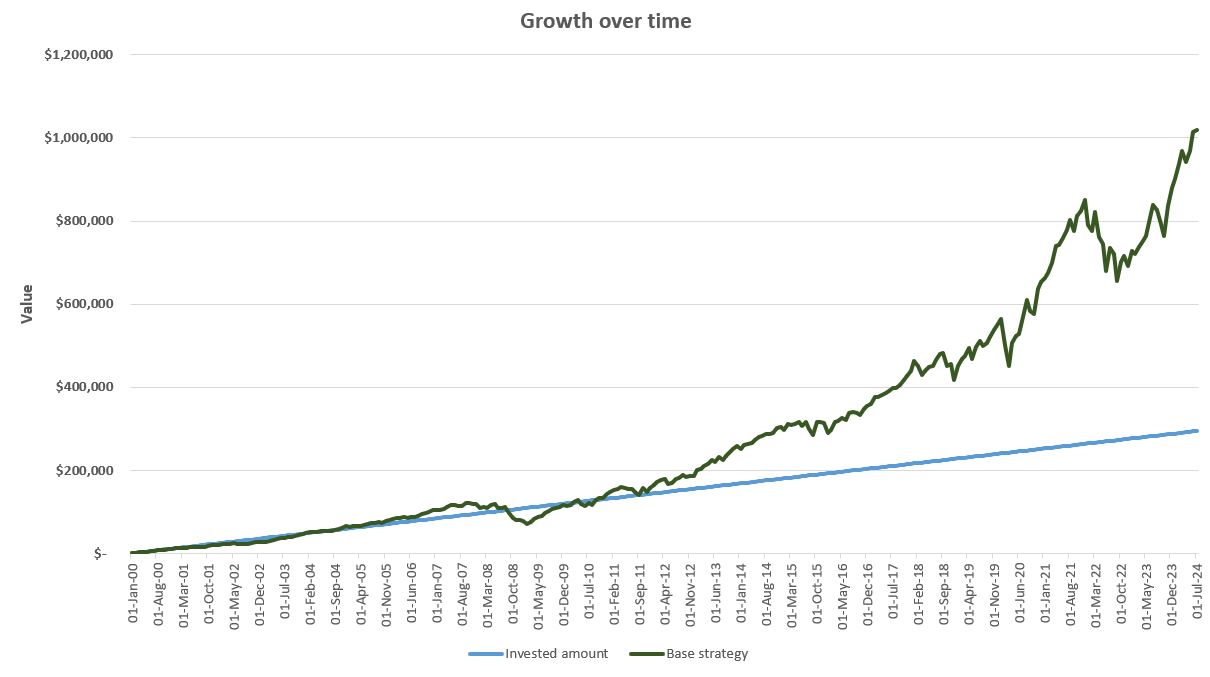

To my surprise, the returns from these strategies were essentially the same over a long investment period of approximately 25 years (from January 1, 2000, to August 16, 2024). Regardless of the strategy used, an investor who consistently invested $1,000 per month would have accumulated around one million dollars by the end of the period.

Compounding reveals its power over time, making it crucial to stay invested in the right index. While the S&P 500 experienced modest returns during the first decade, the most significant growth occurred in the last ten years. Across all the above strategies, the returns were virtually identical.

So, why didn’t buying the dip result in better returns? It seems counterintuitive on the face of it. Let me break it up and share the two main reasons:

- The Market’s long-term growth trend:

The stock market (in this case S&P 500 index) generally trends upward over time, despite short-term fluctuations. In a growing market, waiting for dips can cause you to miss out on growth opportunities. For example, if the market increases by 1% on day one and another 1% on day two but drops by 0.75% on day three, buying on day three means you are still purchasing at a higher price than you would have on day one. Over a long-term horizon, the impact of missing out on growth outweighs the benefits of buying during dips. - The unpredictability of markets:

It is easy to look back with hindsight and think you should have waited for a dip before investing. However, predicting market movements is incredibly challenging. You can not know in advance whether the market will go up or down in any given month. Attempting to time the market based on dips introduces uncertainty that does not align well with the principles of passive investing. It is like a monkey throwing darts in a dark room. Do you think the monkey will win the game? (in this case the passive investor is the monkey with no/limited knowledge of the stock/captal market)

A caution on market dips and investment strategies

While “buying the dip” might work in certain scenarios, such as when rebalancing between asset classes or moving between stocks and fixed income, these are more active trading strategies that require a higher level of market knowledge. In contrast, passive investing (the focus of this blog post) is about long-term growth with minimal effort and expertise. It is about consistently putting your money in the market and letting compounding do the work over time.

Conclusion: Consistency still reigns supreme

The bottom line is this: regular, consistent investing is key to building wealth over time. Whether you invest every day, once a week, or during market dips, the most important factor is staying invested and sticking to a plan. Markets will go up and down, but by maintaining a steady approach, you can smooth out the ride and achieve your financial goals.

If you are unsure which strategy is right for you or how to start investing, consider consulting a trusted financial advisor who can help guide your decisions based on your financial situation and goals.

Disclaimer: https://vinaysachdeva.com/disclaimer/. The opinions expressed in the blog post are my own and do not reflect the view(s) of my employer. The author might have stock ownership in the companies described in this blog post. Data Source- https://www.investing.com/indices/us-spx-500-historical-data