Introduction

New immigrants play a vital role in the social, cultural, and economic fabric of Canada. From history to the present day, immigrants have helped shape and define the Canadian identity.

In this article, I want to discuss why new immigrants are important to Canadian banks and the different ways in which banks can target these New to Bank(NTB) customers. I specifically want to analyze if it makes sense for banks to open accounts for new immigrants directly from their home country (i.e., even before they physically arrive in Canada).

Being an immigrant to Canada and working in the fintech space, this article is super exciting for me. So, let us dive into it.

Canada and Immigration

Canada is a country located in North America and is the second-largest country in the world by land area. As of 2021, the population of Canada was approximately 38.2 million people. It has a diverse population, with immigrants making up a significant portion.

According to the 2021 Census, one in four people (~23.0%) were landed immigrants or permanent residents in Canada (i.e. foreign-born). Asia, including the Middle East, remains the top source of immigrants with India, the Philippines, and China leading the charts. The majority of immigrants to Canada settle in the major cities of Toronto, Montreal, and Vancouver.

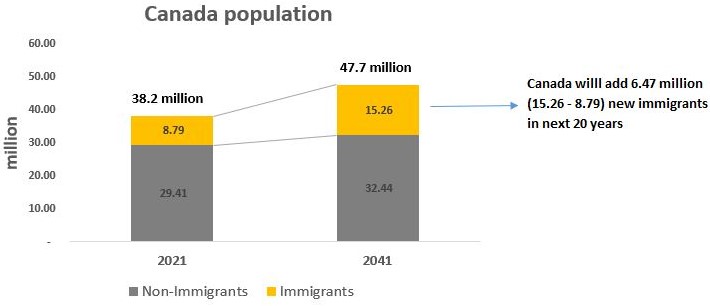

In recent years, Canada has been actively seeking to increase its immigrant population. In 2022 alone, Canada gave Permanent residencies to 432K people (this does not include work visas and international students). According to Statistics Canada’s population projections, immigrants could represent 29.1% to 34.0% of the total population by 2041.

Canada has an aging population. ~65% of immigrants to Canada were in the core working age group. From an economic lens, the immigration of young people into a country has a net positive effect. The government hopes that increasing immigration will help support the country’s economic growth and address labor shortages in industries, which will have a positive impact on the Canadian economy.

Immigration is critical to Canada’s future growth. Canada will add ~6.47 million new immigrants in the next 20 years (from 2021 to 2041).

Canadian Banking Industry

Canada has one of the best and safest banking systems in the world. There are five major banks and several smaller, regional banks and credit unions. These five banks – Bank of Montreal, Bank of Nova Scotia, Canadian Imperial Bank of Commerce, National Bank of Canada, and Royal Bank of Canada – account for more than ~75% of the market share.

Accessibility of banking services in Canada is incredibly high and ~99% of adults in Canada have a bank account.

Let us look at market characteristics in detail:

- Strong market participants: The market has 5 strong players.

- Commoditized services/Product differentiation is limited: For a normal customer looking to open a checking account/get a credit card, it doesn’t matter if it is from Bank A vs Bank B (side note- I understand the difference in regional footprint and branch network, and specialization among advanced products but for the sake of keeping things simple one can safely assume that there is limited differentiation in the market).

- Saturated market: It is a very saturated market with ~99% of adults in Canada(both immigrants and Canadian-born people) having a bank account. Banks can either grow by up-selling &cross-selling or by finding new customers.

- Focus on cross-selling and up-selling: All the banks fiercely compete in the basic categories of collecting deposits and mortgages. These basic segments set the stage for cross-selling other products such as insurance, investments, and credit cards.

- Profitable market: It is a very profitable market. In 2022, all the major banks reported an increase in adjusted net income, growing by 9.21% to $31.5 billion compared to 1H21

The Canadian banking system is saturated with ~99% of Canadian adults having a bank account. A profitable market with limited product differentiation signals intense competition in getting new customers among the banks.

Future growth of the Canadian banking industry

The Canadian banking industry is profitable, it is a saturated market, 5 major players are strong, and product differentiation is limited.

The banks can grow in the below-listed ways:

- Upsell and cross to current customers – Possible, and banks do it all the time. Not in the scope of this article.

- Get customers from competitors – Possible, but it is a zero-sum game for the industry as a whole. It will not result in an aggregate revenue increase for the industry.

- Acquire competitors – Possible, and multiple attempts have been made in this area. The acquisition of HSBC’s Canadian business by RBC is the case in point. Not in the scope of this article.

- Get into ancillary businesses – Banks already do that. Yes, banks can do more in this space, but it is not in the scope of this article.

- Target kids – As kids grow up, they will become customers of banks, and it is an opportunity for banks to target kids as their customers.

- Target new immigrants – Target international students, folks on work visas, and permanent residents because these groups do not have a Canadian bank account when they enter Canada and need a Canadian bank account.

- Expand in international markets – Not in the scope of this article.

- Investment and growth opportunities in other areas like investment banking, wholesale/commercial banking, trade finance, etc. These are lucrative areas but not in the scope of this article.

Let us now calculate the population segments where the banks can get net-new clients, also called NTB(New to Bank) customers. The below models would estimate the new customer count banks can get in the next 20 years (i.e., from 2021 to 2041). The results can be divided by 20 to get the average customer count banks can get per year for the next 20 years.

Growth model 1 (estimates customer growth by population segments)

| Metric | Value | Comments |

| Total Canadian population in 2021 | 38.2 million | As per the 2021 census. |

| Adult population (>18 years old) in 2021 | 31 million | As per the 2021 census. |

| Kids population (<18 years old) in 2021 | 7.2 million | As per the 2021 census. |

| Adults without a bank account | 310K | 99% of Canadian adults have a bank account. 1% of Canadian adults do not have a bank account (1% * 31 million). |

| (A) Kids population without a bank account | 5.04 million | Let us assume 30% of the kids have a bank account. So, 70% * 7.2 million = ~5.04 million kids do not have a bank account. |

| Canadian immigrant population in 2021 | 8.79 million | As per the 2021 census, 23% of the Canadian population is immigrants. So, 23% * 38.2 million = 8.79 million |

| Canadian immigrant population in 2041 | 15.26 million | As per projections, 29.1% to 34.0% (avg 32%) of the Canadian population will be immigrants. So, 32% * 47.7 million (estimated Canadian population in 2041) = 15.26 million |

| New immigrants Canada will add in the next 20 years (from 2021 to 2041) | 6.48 million | Immigrants in 2041 – Immigrants in 2021 = New immigrants added in Canada from 2021 to 2041. So, 15.26 million – 8.79 million = 6.48 million. |

| (B) Adult immigrants Canada will add in the next 20 years | 5.31 million | ~17%-19% of immigrants are kids (equiviant to the % of kids in Canadian population). So, 82% * 6.48 million = 5.31 million will be adult immigrants. |

| (C) Accompanied kids of immigrants added to Canada from 2021 to 2041 who will become adults by 2041 | 585K | Half of the immigrant kids will become adults by 2041, assuming a constant rate of immigration and a normal distribution of age among kids. So, (6.48 million – 5.31 million) * 50% = 585K |

Growth model 2 (estimates total customer growth)

| Metric | Value | Comments |

| Total Canadian population in 2021 | 38.2 million | As per the 2021 census |

| Total Canadian population in 2041 | 47.7 million | The estimated Canadian population in 2041 |

| Population growth in Canada in 20 years | 9.5 million | 47.7 million – 38.2 million = 9.5 million .This growth will come from new kids born in Canada and immigration in this time period |

| % of adults in the population growth | 7.41 million | As per the 2021 census, 78% of the Canadian population is above 18 years old. I am assuming this distribution will not change much in near future. So, 9.5 million * 78% = 7.41 million |

| (D) Userbase growth of Canadian banks in the next 20 years | 7.33 million | 99% of Canadian adults have a bank account. 7.41 million * 99% = 7.33 million |

Model 1 estimates three growth areas for the banks in the next 20 years:-

- (A) Kids population without a bank account in 2021: 5.04 million. All these kids in 2021 will become adults by 2041, and thus will need a bank account.

- (B) Adult immigrants Canada will add in the next 20 years: 5.31 million. All these immigrants will need a bank account. The actual number of accounts to be opened for these immigrants is more than 5.31 million because this segment also consists of international students who will come to Canada to study and go back to their home country but I am not taking those accounts into the calculations for the long-term industry growth lens. (need explanation)

- (C) Accompanied kids of immigrants added to Canada from 2021 to 2041 and will become adults by 2041: 585K. All these immigrant kids will need a bank account.

Model 1 estimates that Canadian banks will add at least 11 million users in the next 20 years.

Model 2 estimates that Canadian banks’ user base will increase by at least 7.33 million users in the next 20 years.

The growth estimate in model 2 is lower than in model 1, as model 1 excludes the user churn due to the mortality rate in the Canadian population.

User base growth (predicted by model 2) = New users growth (predicted by model 1) – User churn due to Mortality

After excluding the mortality numbers, both models predict a very similar estimate of the new accounts to be opened in the next 20 years (i.e. ~11 million new accounts).

Canadian banks will add ~11 million new retail accounts in the next 20 years (avg ~550K new retail account per year). Current Kids and new immigrants will be the two segments which will fuel this growth.

Why should banks target New Immigrants?

We looked at immigration, and the banking industry, and also modeled the future growth of the banking industry in earlier segments. The two major segments that emerged from our models were Kids and new immigrants.

- Kids who will become adults by 2041 will constitute 45% of the growth for banks (~5 million new accounts) in the next 20 years.

- New immigrants and their kids will constitute 55% of the growth for banks (~6 million new accounts) in the next 20 years. 6 million is a conservative number as I have not taken international students into consideration who decide to move back to their home country.

So, it is clear that immigrants will be the key segment of growth to get new customers, and banks should target them.

An immigrant’s journey to Canada

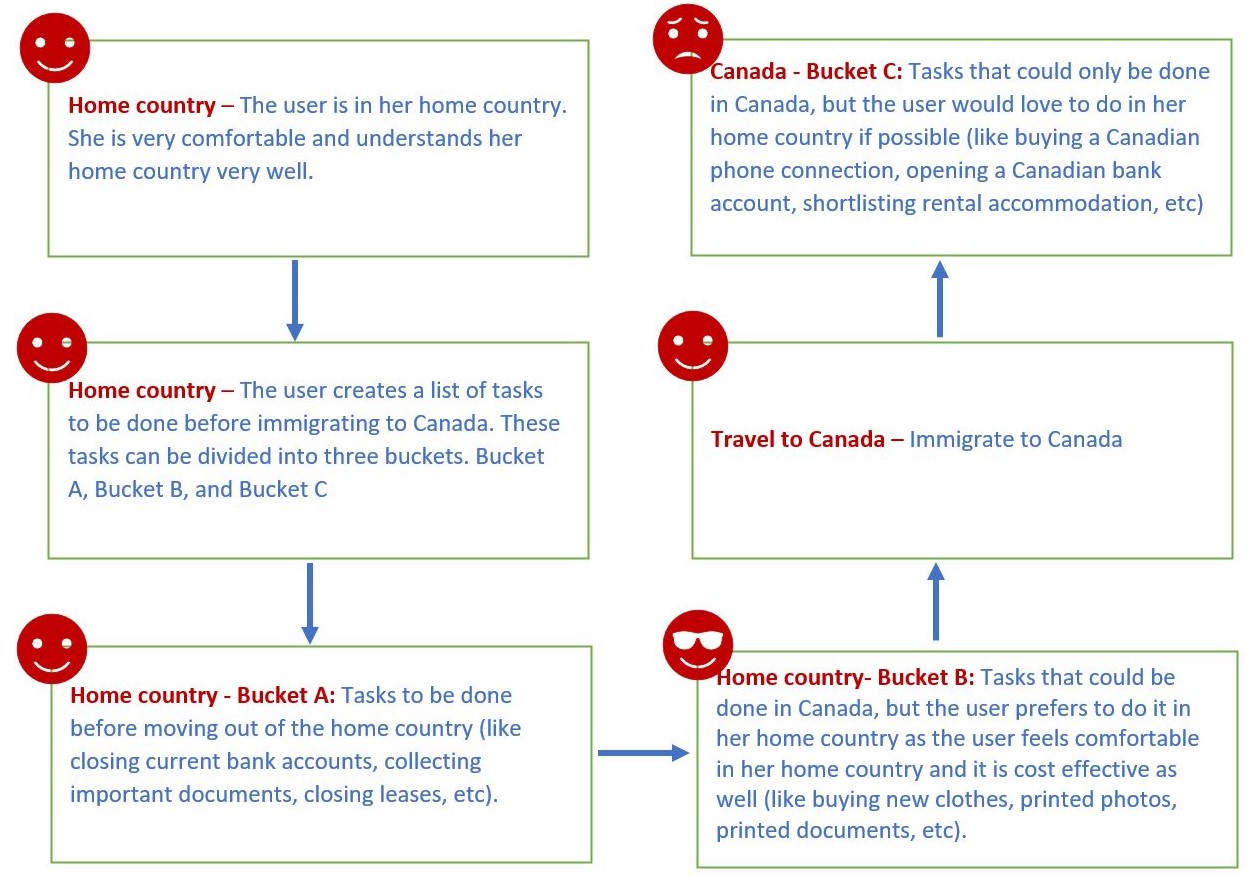

Moving to a new country is always a difficult task and makes a person get out of his/her comfort zone. When immigrants come to Canada, everything is new for them. New immigrants are dependent on the information they have gathered from social media, relatives, and friends. They do not have any first-hand information or experiences as they are new to Canada.

Making decisions with limited information/experience becomes a challenge for them and it brings uncertainty in their life.

Immigrants like to complete most of the work/checkmark their list at the pre-immigration in their home country to avoid any uncertainty in Canada (e.g., getting print out of important documents, printed photos, Canadian currency cash, buying clothes, etc.).

Let us also look at the pain points of new immigrants when they reach Canada:

- No first-hand experience: They do not have first-hand experience/understanding of the Canadian market.

- Reliance on the internet and friends: New immigrants rely on social media, internet research, and advice from friends and/or family for information on the Canadian market.

- Need to get the products/services quickly: New immigrants can not wait to get the products/services they need and hence have to make quick decisions (e.g., getting a phone connection, opening a bank account, finalizing accommodation, etc.).

- Limited funds: New immigrants have limited funds but many concurrent expenses. So, they generally do not want to overspend in the initial stages of their move.

- Information overload: There is a bunch of information immigrants come across and it is tough to process all of it at the same time. Immigrants get overwhelmed by it.

New Immigrants do not have first-hand experience with the Canadian market when they move to Canada. They love to finish as many tasks in the comfort of their home country before immigrating to Canada.

How should banks target New Immigrants?

Now that we have established the importance of new immigrants to the Canadian banking industry’s growth, let us look at key strategies/channels by which banks can target new immigrants. Any approach/strategy the banks decide on should address the pain points of immigrants.

We can not get into the tactical aspects but can look at the board themes.

- Use digital channels: Most immigrants look at social media, and internet forums to get information about Canada. Digital channels can be effectively used to reach out to new immigrants in their local language + create a personalized and targeted reach-out strategy.

- Move upwards in the user journey: New immigrants love to finish most of the possible tasks in their home country before moving to Canada (as they are comfortable in their home country, have ample time with them, and understand the home country very well). If banks can move upwards in the user journey and offer an option to open a Canadian bank account in the user’s home country, then users will want to open a Canadian bank account from their home country.

- Partner with trusted institutions: Information from a trusted source is super important for new immigrants as they have not experienced anything first-hand in Canada. Partnering with trusted institutions like colleges/universities, fintech/banks in the home country, community leaders, etc becomes an important aspect.

- Do not charge fees + offer rewards: New Immigrants will not pay a higher amount for the products and services in Canada as they are still mentally converting and comparing prices in their home country currency. They also have a lot of expenses to make and generally not many income source(s). They would love to get rebates and rewards.

- Give bundled offerings: A user(new immigrant) doesn’t just need one product/service when she immigrates to Canada. A user will need a phone connection, broadband connection, checking bank account, debit card, credit card, Uber/Lyft for travel, subway access for travel, car rental/lease/purchase, realtor for getting accommodation, library card, etc. Today, the user visits different places to get each of these services. If banks can club a few/all of these important products/services as a bundled offering for the user, then a lot of pain points of the user will get resolved.

Banks are already using most of these approaches/themes to target new immigrants but more value can be extracted from “Move upwards in the user journey” and “Give bundled offerings”.

‘Offering bundled packages’ and ‘moving upwards in the value chain’ can help banks offer a lot of value to New immigrants (which will effectively lead to more value for banks from these customers in the future)

Offering bundled packages to New Immigrants

As per Investopedia, bundling is when companies package several of their products or services together as a single combined unit, often for a lower price than they would charge customers to buy each item separately.

Companies do bundling for different business reasons but the common reasons are to get the user to spend more or let the customer get more perceived value. We see this happening across multiple places e.g. Mcdonalds’ value meals, travel bundles, etc.

As I mentioned earlier, a new immigrant doesn’t just need one product/service when she immigrates to Canada. She will need multiple services/products like a phone connection, broadband connection, checking bank account, debit card, credit card, Uber/Lyft for travel, subway access for travel, car rental/lease/purchase, realtor for getting accommodation, library card, etc. Today, she visits different places to get each of these services. If banks can club a few/all of these important products/services as a bundled offering for the user, then a lot of pain points of the user will be resolved.

From an immigrant’s lens, getting bundled services will be a lifesaver as it reduces a lot of headaches for the user and lets the user start a new life in Canada with ease.

I know there will be criticism that this approach will get the banks to move away from their core competence (which is banking rather than selling internet connections in bundles). I would suggest that there are smart ways for banks to structure and execute these bundles without moving away from their core competence.

Move upwards in the user journey– Can banks open accounts for new immigrants directly from their home country (i.e. even before they physically arrive in Canada)

As discussed earlier, New immigrants love to finish most of the tasks in their home country before moving to Canada (as they are comfortable in their home country, have ample time with them, and understand their home country very well).

If banks can move upwards in the user journey and offer an option to open a Canadian bank account in the user’s home country, then users will want to open a Canadian bank account from their home country itself.

This can be done by partnering with a bank/reputed fintech in the home country of the immigrant. This can be piloted with countries that top the immigration list – namely India, the Philippines, and China.

e.g. if HDFC bank or PayTM (in India)/ BDO Unibank/ GCash (in the Philippines) or China Merchants bank/Ant financial (in China) partner with one of the Canadian banks and offering a Canadian checking account to upcoming immigrants before they move to Canada.

This can also be done with immigration agents in the home country of the immigrant, but I would prefer working with banks and/or fintech due to their trust and reach advantages.

Banks need a Canadian ID before they can open a full-fledged checking account/offer debit/credit cards to customers. There are ways in which Canadian bank accounts can be opened by people outside Canada but there is a need to work on the legal structuring aspect of such accounts to make them KYC lite and scalable. (i.e., limited rights to access the account, limited/one-time money transfer/escrow accounts which get converted to a full checking account once the user lands in Canada and submits the document to banks via email/branch walk-in).

This playbook can be applied to all the countries/regions which top the Canadian immigration list and it can be executed at scale digitally and at low cost.

This approach could help banks establish relationships with NTB customers early on, while also providing a convenient and efficient way for new immigrants to manage their finances as they transition to life in Canada.

Use case in other industries

The pain points and opportunities mentioned in this article also apply to other industries like insurance, rentals, phone connection, grocery, etc.

I believe there is an opportunity to create a marketplace to bundle these services for new immigrants.

There will be many businesses that will be built around new immigrants in Canada as it is a growing segment of the population, falls under the working age, needs services/products, and also has paying capacity(atleast in future).

Also, Happy New Year to folks who reached the end of this article.

Disclaimer: https://vinaysachdeva.com/disclaimer/. The opinions expressed in the blog post are my own and do not reflect the view(s) of my employer.